by Ray Wilson

One outcome of the 1836 Tithe Act was that a detailed land usage survey was carried out in the majority of parishes in England and Wales. Three copies of the map and associated documentation were made at the time and so usually at least one copy has survived to provide an immensely valuable resource for local historians. This note gives a brief introduction to the custom of the payment of tithes followed by an account of the information available to local historians from the Wotton Tithe Map and Apportionment of 1842.

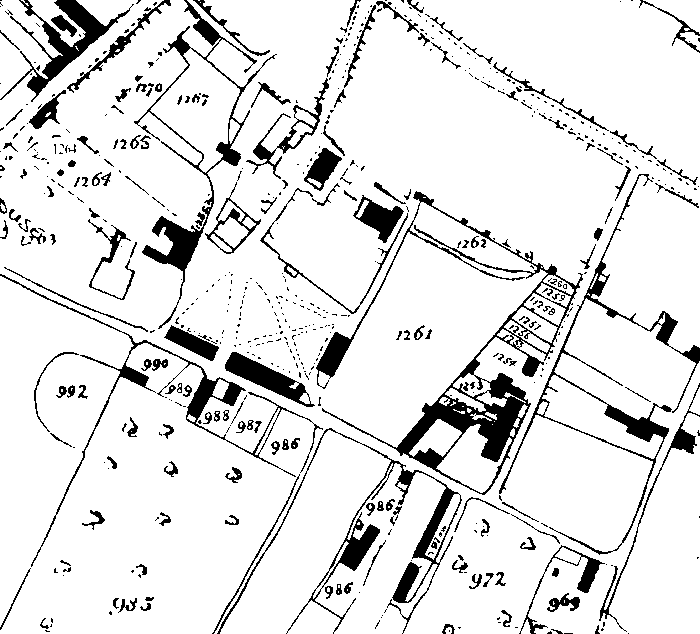

Original scale 1:2376

The payment of tithes was certainly established in England by the twelfth century. Originally, parishioners contributed an agreed proportion of their yearly profits from farming or cultivation to support the clergy, maintain churches and assist the poor (1, 2). The proportion payable was commonly one tenth and the tithes fell into three categories. The predial tithes were payable on all things arising from the ground and subject to an annual increase. This covered produce such as grain, wood and vegetables. The mixed tithes were payable on all things nourished by the ground and included calves and lambs and animal produce such as milk, eggs and wool. Finally, the personal tithes took account of the produce of man’s labour like the profits from mills and fishing.

Tithes were also divided into great and small tithes. It was common for grain, hay and wood to be considered as great tithes and all the other predial tithes together with all mixed and personal tithes to be classed as small tithes. Great tithes were often payable to the rector and the small tithes to the vicar of the parish but this was by no means always the case. At the dissolution of the monasteries many of the rectorial tithes passed into lay ownership and naturally there could be strong resentment at having to pay tithes to an owner who might live miles from the parish.

In principle, tithes were payable in kind, the tenth sheaf, the tenth fleece, the tenth calf and so forth but from very early times arrangements were made in some instances for money to be paid rather than the actual products of the land handed over. The tendency for the substitution of a money payment was stimulated by enclosures, particularly the parliamentary enclosures of the 18th century. Enclosures were often made to improve the land and its yield. If they had proceeded without some changes in respect of the tithes the tithe owners would have automatically received an increased income without contributing to the improvements. The obligation to pay tithes could be removed in one of two ways: allotment of land in lieu of tithes or substituting payment in kind by a cash payment (known as commutation). The extent of the land allotted or the land charged with a money payment was generally shown on a map attached to the Enclosure Award.

Statutory enclosure was widespread but it was carried on in a piecemeal fashion as each case tended to be initiated by local landowners. By 1836 tithes were still payable in the majority of parishes in England and Wales. However, the Government of the day had decided upon the commutation of tithes and the 1836 Tithe Act was passed to achieve this. The reasons for commutation stated by the Home Secretary, Lord John Russell, when he introduced the Bill were that tithe was generally held to be ‘a discouragement to industry, a penalty on skill, a heavy mulct on these who expended the most capital and displayed the greatest skill in the cultivation of the land’.

After the Act was passed three Tithe Commissioners were appointed and the long process of commutation began. Their first task was to discover to what extent commutation had already taken place. They had the advantage that a complete statement had been recently produced, for the purposes of the census, giving all the parishes and non-parochial places that the country was divided into. Enquiries were directed to each of these administrative units and if necessary an Assistant Commissioner appointed to oversee commutation for that area.

The Assistant Commissioner held various meetings in the district and in some cases an agreement between the tithe owners and the landowners was reached. Where this could not be achieved the Tithe Commissioners made an Award to the tithe owners and determined the amounts that would form the basis of the annual payments (or rentcharges) to the tithe owners by the land owners. These amounts were set out in a schedule called the Apportionment and were based on the size of each parcel of land and the use it was currently put to. The actual payments could vary from year to year according to the seven year average price of wheat, oats and barley. Hence the name corn rents was commonly used for payments in lieu of tithes. From 1846 it was possible to extinguish the liability to pay rentcharges by payment of a lump sum. All the remaining tithe rentcharges were abolished by the 1936 Tithe Act and substituted by redemption annuities payable for 60 years, to end in 1996. However, the scheme was wound up prematurely under the 1977 Finance Act (1).

As Wotton is a relatively large parish with a large number of landowners it was perhaps inevitable that an Award had to be made rather than an agreement reached. The Assistant Commissioner appointed to deal with Wotton was Charles Pym.

The Award required an accurate survey to be made of the parish giving all the relevant acreages, owners and state of cultivation. At this time only the one inch to the mile ordnance survey maps had been published and clearly these were unsuitable for the basis of the survey. Therefore, in most cases a new map had to be drawn up. The surviving maps vary greatly in scale, accuracy and size. Happily, the Tithe Map for Wotton-under-Edge was drawn at one of the larger scales used (3 chains to one inch or 1: 2,376 or more than 26 inches to the mile). Furthermore, it was judged to be of sufficient accuracy so that the Tithe Commissioners ultimately applied their seal to it. This was only done in approximately one sixth of the cases, the so-called ‘first class’ maps. Where the map had been sealed it could be deemed to be evidence of the quantity of land. The high costs of the survey and map had to be borne by the landowners and this was sometimes a significant factor in whether agreement could be reached or not. Legally the map and the apportionment formed one document and were sewn together. However, nearly all the surviving pairs have been separated to improve handling.

The Wotton Apportionment was signed in November 1842 and the map must have been in existence at that time. However, the map was not sealed until November 1847 when two of the Tithe Commissioners, J W Buller and Richard Jones signed and sealed it. The original was retained by the Commissioners and certified copies were deposited with the Registrar of the diocese and the incumbent and churchwardens of the parish. The original is now at the Public Record Office.

The figure shows a small portion of the Tithe Map redrawn for clarity at full scale which covers the Chipping and its surroundings. It is unfortunate that many of the properties in the central area of the town are not shown. This is because there were no tithes payable on these properties and so the surveyors did not go to the expense of drawing up this part of the map.

Each tithe area on the map is numbered and the relevant details for that area are shown against the corresponding number in the Apportionment. The format of the Apportionment is fairly standard and the one for Wotton follows this pattern. After the preamble it is laid out in columns which give, number, name(s) of the landowner(s) and occupier(s); acreage, name or description and state of cultivation of each tithe area; the amount of rentcharge payable and the name(s) of the tithe owners.

The preamble states that the owners of both great and small tithes were the Dean and Chapter of Christ Church, Oxford and that Lestrange Southgate Austin of Wotton under Edge held a lease on the tithes. Thus Christ Church received an agreed sum each year from Austin who then had to collect more that that sum in order to make a profit. Austin was from the well known family of clothiers but appears to have been involved in banking and finance and not cloth. In lieu of all the tithes he was awarded £969 12s 6d from a total area of 4860 acres spread over 1565 numbered plots. Arable land accounted for 1800 acres and meadow and pasture for a further 2500 acres. There were 360 acres of woods, 150 acres of orchards and 50 acres of gardens and sites with houses or cottages. A study of the field names is fascinating revealing names like Dollwaggers, Douse Throat, Thieves Pit, Toadpool Leaze and Tuggers Ashleaze. Farms and industrial premises such as the mills are shown in detail along with inns and malthouse.

The Wotton Tithe Map is such a useful resource for local historians that it is not surprising that various copies have been made at different times. A full scale photographic copy of the Tithe Map and a typescript of the Apportionment (3) were obtained by the Wotton Historical Society probably over forty years ago. This has been annotated with the field names in red ink. The Gloucestershire Record Office also holds another full scale photographic copy of the Map and a typescript of the Apportionment (4). Mrs Joyce Popplewell, a member of the Society, made a reduced size copy in the 1980s which also shows the field names (5). Finally, Mr Geoff Gwatkin of Ross-on-Wye included Wotton in his series of Gloucestershire Tithe Maps. This is also at a reduced scale from the original and shows the field names and state of cultivation (6). To improve access to the Wotton Apportionment the Author has been transcribing it into a suitable computerised format. The intention is that the document will be published on the Internet where is will be available to a much larger audience than it is at present. Such is the value of the Tithe Map that perhaps one day it will also be available in the same way.

References

(1) Public Record Office Domestic Information Leaflet No 41, Tithe Records: A Detailed Examination (also available on the PRO website).

(2) R J P Kain and H C Prince, The Tithe Surveys of England and Wales, Cambridge, 1985.

(3) Photographic copy of the Wotton Tithe Map, Wotton Heritage Centre, (50=80.1019) and typescript of the Apportionment, (50=80.1020).

(4) Photographic copy of the Wotton Tithe Map and Apportionment, Gloucestershire Archives, D439.

(5) Copy drawn by Mrs Joyce Popplewell, Scale: 6 inches to one mile, Wotton Heritage Centre, 50=80.1017.

6) Copy drawn by Geoff Gwatkin, Ross-on-Wye, (No 87 in a series), Scale: 6 inches to one mile, Wotton Heritage Centre, 1998:98,1995.